Ashley Medows

- 5+ Years Experience

- Supports All 50 States

plus a Dedicated HR Manager for $9/mo

Did you know?

Bambee clients are 4x less likely to have a complaint filed against them.

01 HR AUDITS

Quickly Identify Your HR Gaps

HR rules change. Audits let you identify any HR gaps, and then we help you with an action plan to get your internal practices up-to-date to keep protecting your company and employees.

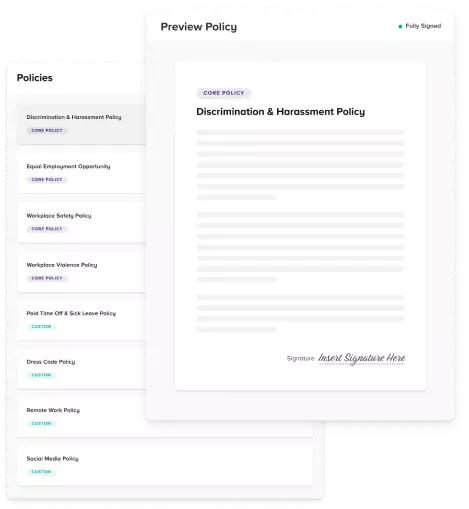

02 HR POLICIES

Policies That Protect Your Business and Standardize Your Culture

HR Autopilot makes sure all core, protective policies are current, signed by your employees, and reaffirmed semi-annually. Then, your dedicated HR Manager crafts any custom HR policies your business needs.

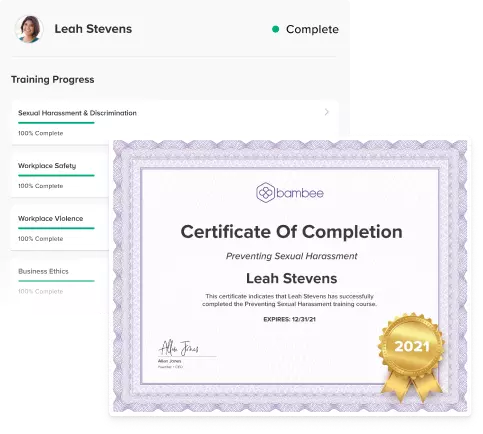

03 TRAINING & CERTIFICATIONS

Training That Keeps Your Staff Compliant and Productive

Bambee takes care of important and often-mandatory training like sexual harassment, workplace safety, and business ethics - and reports back to you on everyone’s progress.

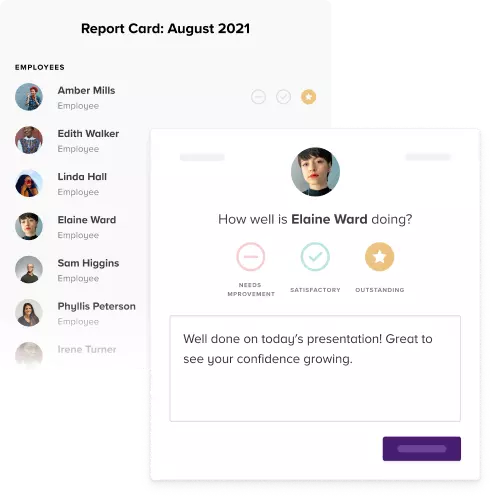

04 STAFF PERFORMANCE TRACKING

Deliver Feedback to Improve Employee Performance

Bambee’s Report Cards help you track your staff against their goals, and open up a regular dialogue to give praise, constructive feedback, or take corrective action.

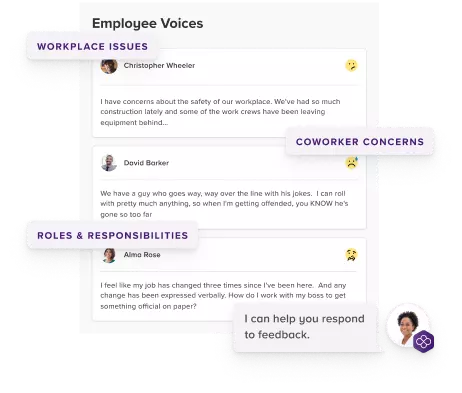

05 UNDERSTAND EMPLOYEE MORALE

Create A Space For Employees to Speak Their Thoughts

Employee Voices lets your employees share concerns and alert you to potential problems. But it doesn’t have to be bad news - it’s also a great way for your staff to express gratitude, anonymously or publicly.

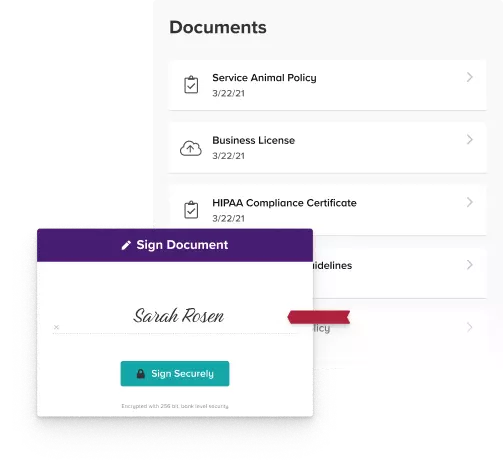

06 COMPLIANT DOCUMENT STORAGE

Comply with EEOC Document Retention Standards

Federal & state laws mandate that certain company files be held for a certain period of time. Plus, never guess who signed what - or where your important HR documents are. They’re all gathered safely in your Smart Cabinet.

As a small business, Bambee was exactly what we needed for HR. Affordable, professional, and friendly! We absolutely recommend them.

Ashley Medows

Employee Relations & HR Problem Solving

The most sensitive issues require rich dialogue. Your HR Manager engages with you to create the right outcomes for your business.

Craft HR Policies, Procedures & Shape Company Culture

Your HR Manager builds policies specific for your businesses based on labor regulation and your unique company culture for better alignment.

Onboarding, Terminations & Navigating Labor Regulations

Lean on Bambee for onboarding, terminations, and corrective actions and get clarity on all your regulatory questions.

Employer Coaching & Guidance

Your HR Manager gets to know you on a first name basis and gives you full remote HR support plus coaching where you need it.

Your HR Manager is available by phone, email, or chat!

We are a growing company that needs help with our HR. We have hired Bambee and thus far have been very happy. Our HR Rep has been attentive and quick to respond with valuable HR knowledge. We are building our HR policies and processes way quicker than I alone would have been able to do.

Automating Compliance Reviews Keeps Companies on Track

People want to work at companies that are making best efforts to follow fair HR practices and create rules-based environments.

Understanding HR Policy Creates Alignment

Employees do better when they understand the rules around the culture they contribute to.

Coaching Helps Employees Reach Professional Goals

Every employee deserves to know how they’re performing at their jobs and how they can perform better in their role

In App Training Empowers Employees With Workplace Knowledge

Giving employees the tools to follow the rules increases the likelihood they do so.

Responding to Feedback Holds the Company Accountable

Resentment is the number one contributing factor to poor performance and labor claims. Giving employees a safe place to voice concerns is key to addressing them.

Did you know?

Only 12 percent of U.S. employees strongly agree that their company does a good job of onboarding new employees.

Flexible plans and features. Honest pricing. No hidden fees.

$99/mo

No Setup Fee

$299/mo

Plus a $500 one-time setup fee

$399/mo

Plus a $500 one-time setup fee

$499/mo

Plus a $1,500 one-time setup fee

$1,299/mo

Plus a $2,000 one-time setup fee

Custom

Plus a $2,500 one-time setup fee

Small Business Focused

We only service businesses with less than 500 employees. That means we deal with your types of needs all day, every day.

The Best of Modern Tech

We use cutting edge data technology to stay informed about labor laws & help you avoid mistakes.

HR Practice Automation

HR Autopilot automates your key HR practices to keep you HR compliant all year through.

THE BAMBEE GUARANTEE

Your HR Manager will be a certified Bambee HR professional, experienced with companies of your size, and trained in compliance and customer service. All customized HR work is included with your fixed, monthly cost. Any additional services you desire will have a clear and upfront price. Never any hidden fees.

What is Bambee?

Bambee is the first outsourced human resource compliance solution for small businesses. With your own dedicated HR Manager and HR Autopilot, Bambee helps your business with employee onboarding, conflict resolutions, terminations, federal and state HR compliance, and general HR policy and guidance.

How Does Bambee Work?

How much does Bambee cost?

Can Bambee help my size of business?

Can Bambee help me terminate employees?

Prices starting at $9/month

Ready to put your HR on autopilot?